Strategic Implications of Recent UBI regulation in India

Auto Insurers need to carefully analyse costs & benefits while forming strategy for Usage Based Insurance. Choosing right Business Model and Telematics Technology are key.

Smartphone sensor based Safe Driving Technology inside your App. Engages Customer and ecourages Safe Driving Behavior.

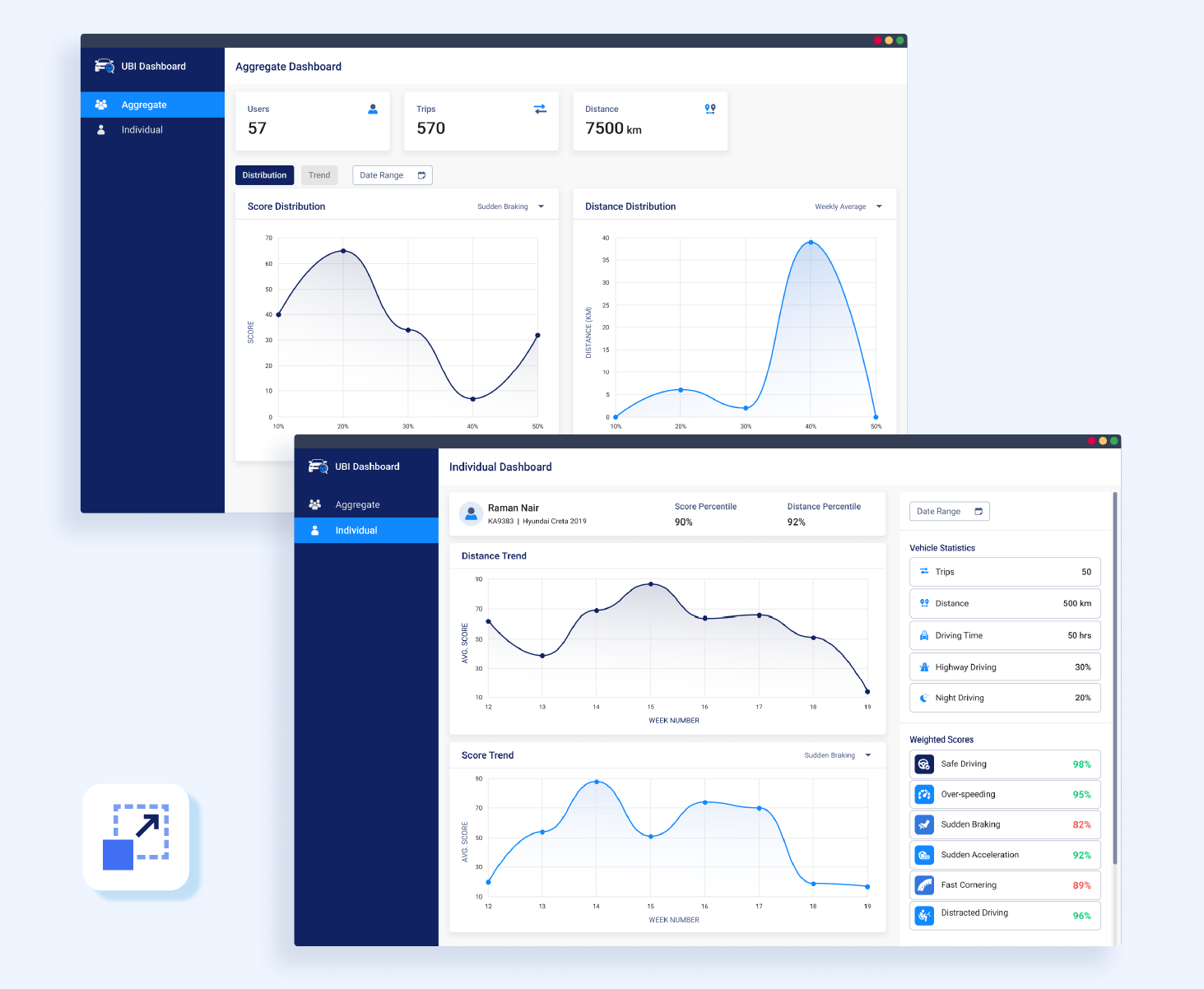

Accurately identify safe and risky drivers via our comprehensive Safe Driving Score.

Our Driving Behavior Analytics capture our distilled insights from years of Telematics and Vehicle Data Analytics experience.

Our Smart sensor fusion technology logs and scores each drive accurately on multiple risk dimensions.

Use Safe Driving Scoring for pricing prior to Policy period (Try-before-you-buy) or during the Policy period (Pay-how-you-drive).

AutoBeacon App delivers personalized insights to improve safe driving behavior while maintaining end user privacy.

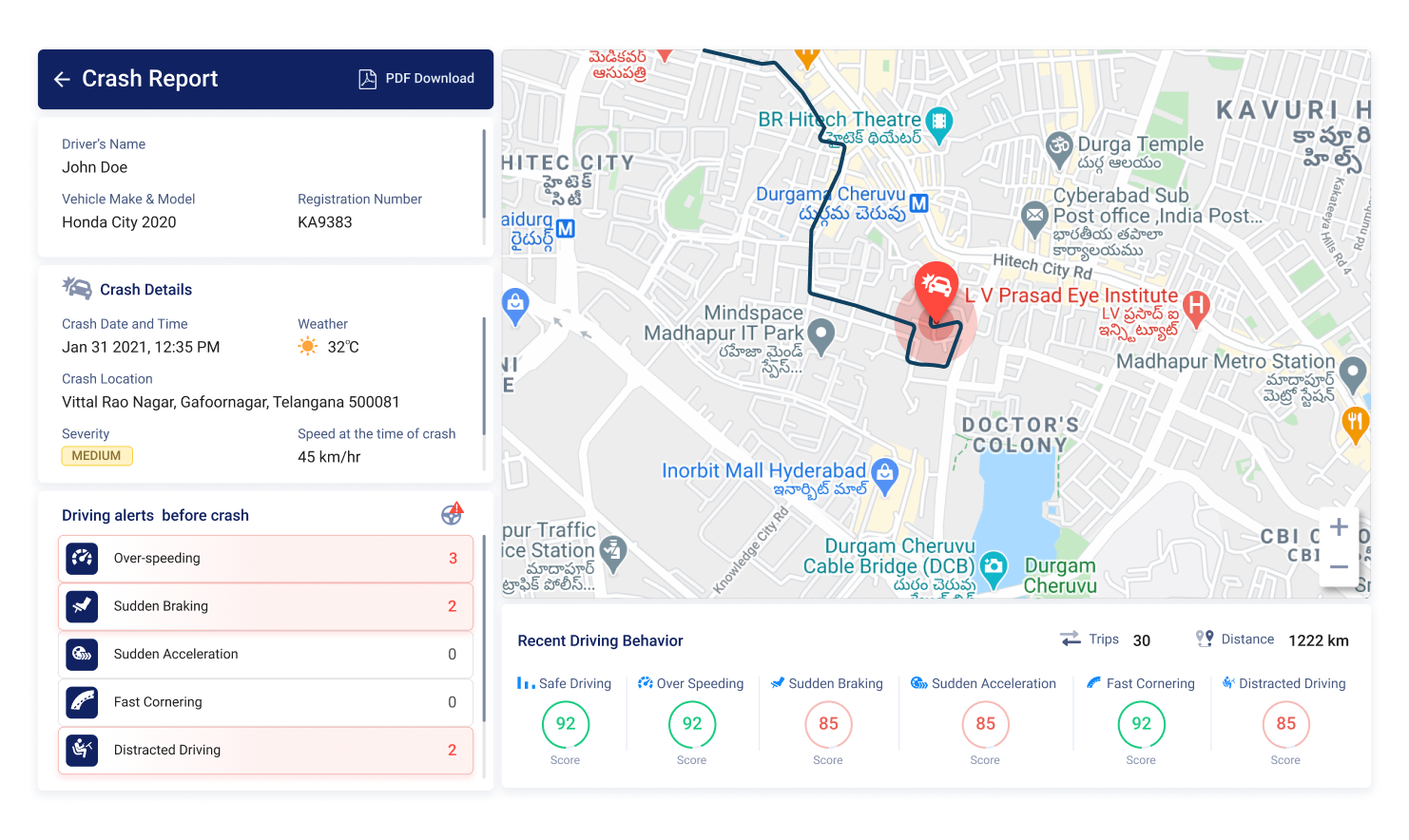

Detailed Trip View shows all rash driving alerts in context of drive path.

Advanced Distracted Driving Detects actual phone pickup or texting movement during driving.

Drive Positive Behavioral Change in your customer base and reduce Claim frequency and severity.

Our Customer Analytics Engine generates dynamic and personalized notifications based on Vehicle Usage and Safe Driving Scores.

Engage with car owners using Gamified Leaderboards and Digital Badges based on their Driving Behaviour.

Great for Insurers and Insurance intermediaries to increase Digital touch-points, Build relationship and Increase Retention.

Leverage our AutoBeacon Mobile SDK and APIs to incorporate our core data processing library inside your own App and launch your UBI product in weeks. Our Field proven SDKs enable quick integration into your native Android, native iOS or Flutter App.

Alternatively, launch even faster with our Embeddable Telematics App inside your App (on Android and iOS). Embeddable Telematics App is our SDK along with User Interface pre-built for UBI and customer engagement.

Automatically Detect crashes, provide emergency assistance and get data-driven Crash re-construction report for Claims Intelligence.

Cloud based Business Intelligence Tool for Aggregated Data Analytics and APIs for Underwriters to decipher driving trends and segment customers based on risk

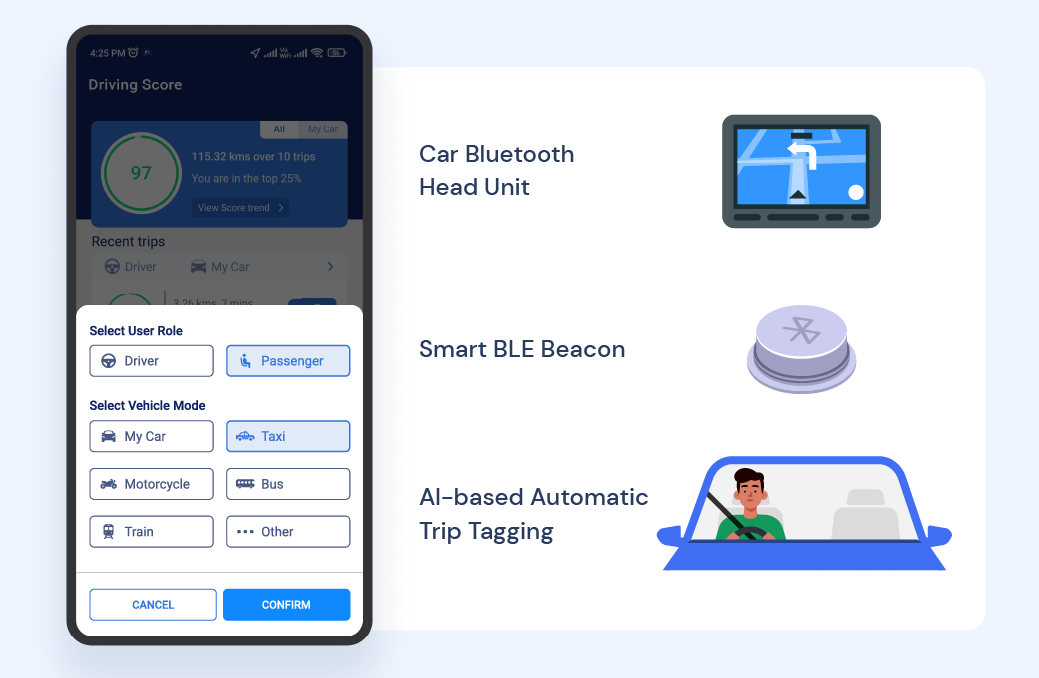

AutoBeacon has mechanisms to identify trips taken by the User in own vehicle, which are of interest from UBI perspective

Bluetooth Connectivity to Infotainment Unit of the Vehicle

Proximity to a BLE Beacon placed in the vehicle

Artificial Intelligence techniques that learn the pattern of driving behaviour of User

AutoBeacon also works with low cost, wireless device (Beacon) in the vehicle. Beacon placed in the insured car ensures only valid driving data from that car is scored. Beacon's built-in accelerometer sensor offers higher fidelity of Driving Behaviour Monitoring and Crash Detection.

AutoBeacon Smartphone Telematics is at the core of our path breaking On-demand Motor Insurance Product. AutoBeacon SDK powers advanced Driving Behaviour Scoring in our Switch2.0 App. We see AutoWiz as a long term partner in our journey of bringing innovative, technology enabled Insurance products in the Indian market.

Pure Smartphone based Telematics to OBD Connected Car Solutions

Auto Insurers need to carefully analyse costs & benefits while forming strategy for Usage Based Insurance. Choosing right Business Model and Telematics Technology are key.

Read our Viewpoint Article on Prospects of Connected Auto Insurance in India. We discuss the key growth drivers including Better Risk Pricing and Customer Engagement.

In our conversations with Auto Insurers, certain questions on Telematics Insurance come up quite often. We list the top 5 questions and how our Telematics solutions address these.

We explain and discuss the growing Road Safety risk posed by Distracted Driving. Also, what technology and behavioral measures we can take to prevent it.

Smartphone-based Telematics as the technology option for Usage-Based Insurance is a growing trend. We explain why?