Strategic Implications of Recent UBI regulation in India

Auto Insurers need to carefully analyse costs & benefits while forming strategy for Usage Based Insurance. Choosing right Business Model and Telematics Technology are key.

Increase Safety and Profits with

AutoWiz Insurance Telematics Solutions

Cutting Edge and Custom Fit for You

For Pay-how-you-Drive and Pay-as-you-drive UBI Business Models

Choose based on your use case and budget – Smartphone only or with OBD Device

Crash Detection, Live Tracking, Car health monitoring and diagnostics

App SDKs and APIs enable you to customize, integrate and launch quickly

Our Solutions capture our distilled insights from years of Vehicle Data Analytics experience.

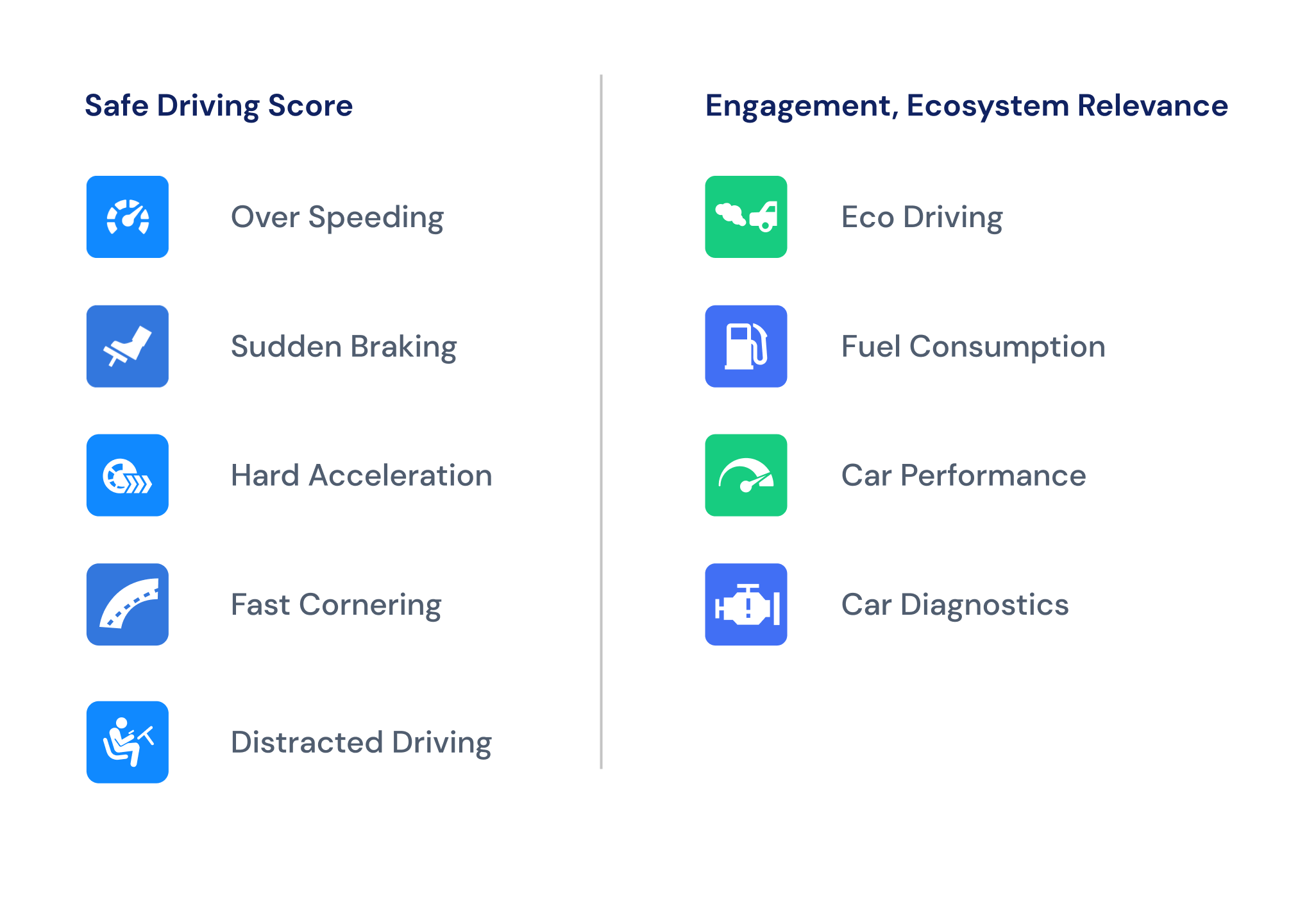

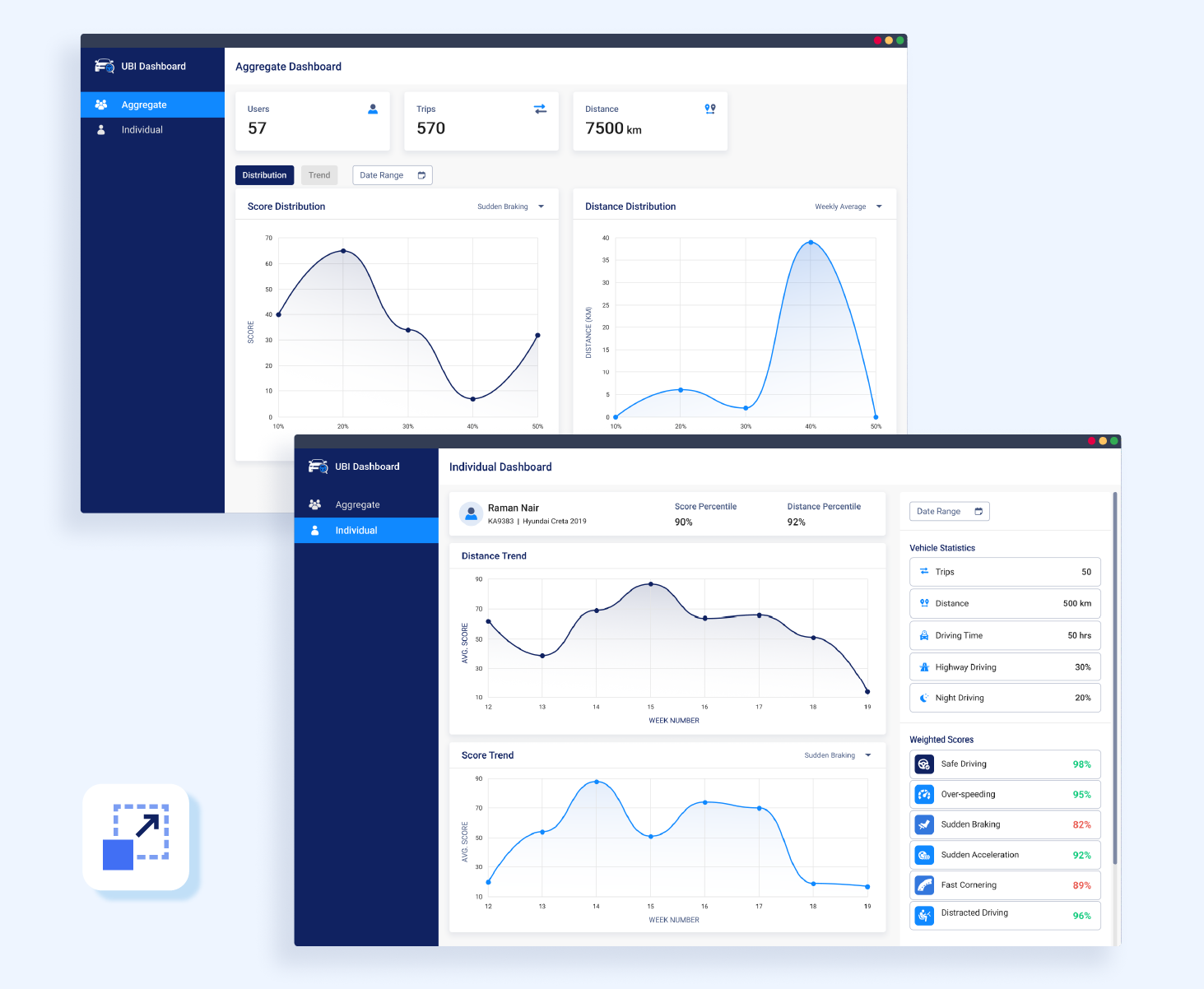

Comprehensive analytics rates each drive on multiple risk dimensions, including driving behavior and additional risk parameters.

With OBD, car performance and eco-driving behavior analytics enables ecosystem engagement.

Customizable scoring tailored as per your UBI product strategy.

Our Insurance Telematics Apps deliver personalized and engaging insights, while maintaining end user privacy.

Driving Behavior Scoring Trends to encourage safe driving.

Detailed trip view shows rash driving alerts in context of drive path.

Customer Analytics Engine drives Gamified Leaderboards and personalized notifications.

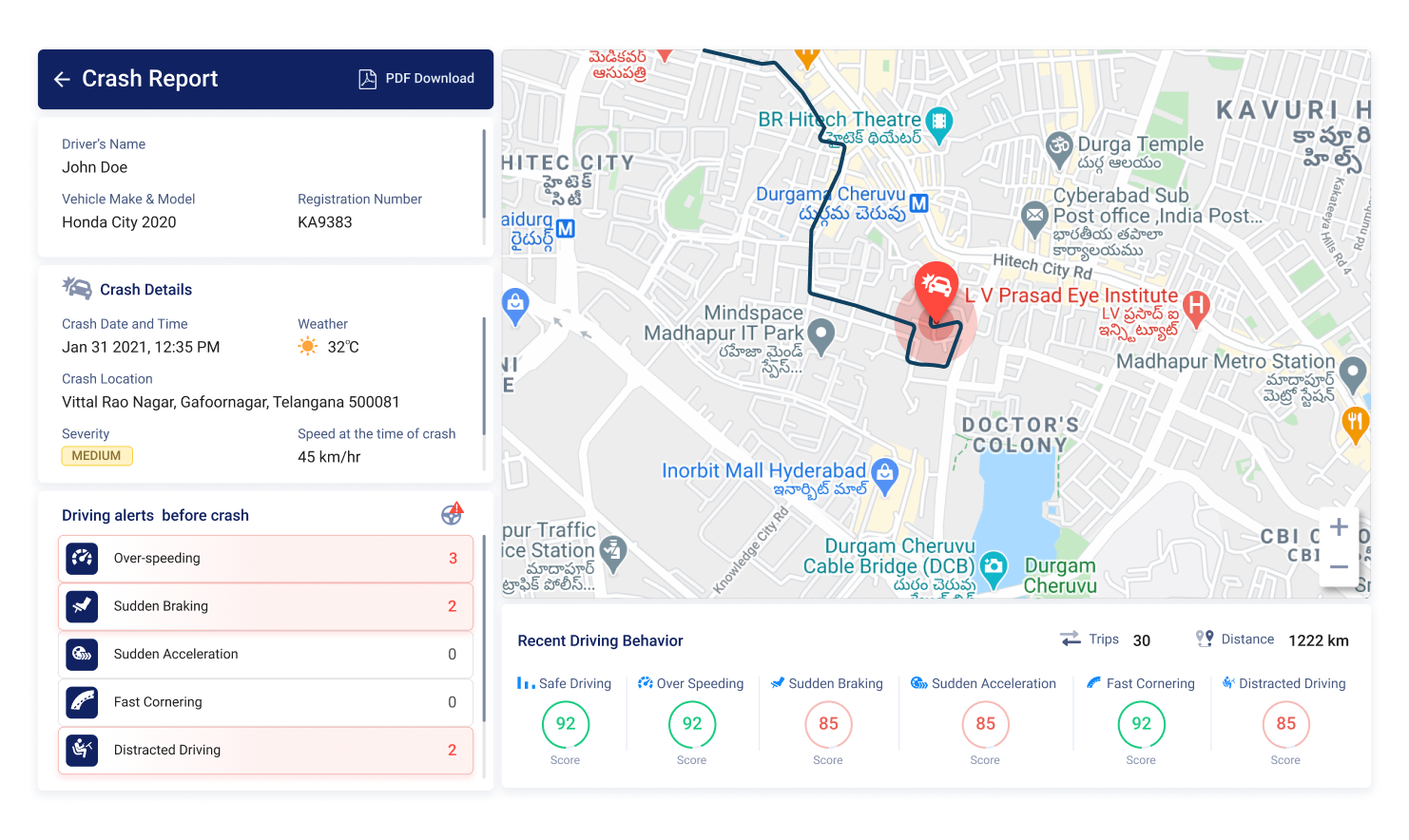

Automatically Detect crashes, provide emergency assistance and get data-driven Crash re-construction report for Claims Intelligence.

Aggregated Data Analytics and APIs for Underwriters to decipher trends and segment customers based on risk

Pure Smartphone based Telematics to OBD Connected Car Solutions

Auto Insurers need to carefully analyse costs & benefits while forming strategy for Usage Based Insurance. Choosing right Business Model and Telematics Technology are key.

Read our Viewpoint Article on Prospects of Connected Auto Insurance in India. We discuss the key growth drivers including Better Risk Pricing and Customer Engagement.

In our conversations with Auto Insurers, certain questions on Telematics Insurance come up quite often. We list the top 5 questions and how our Telematics solutions address these.

We explain and discuss the growing Road Safety risk posed by Distracted Driving. Also, what technology and behavioral measures we can take to prevent it.

Smartphone-based Telematics as the technology option for Usage-Based Insurance is a growing trend. We explain why?